Biden halts major foreign arms deals, Wall Street gets trolled and how mindfulness can reshape working life

25 - 31 January 2021

Farewell January, welcome February! 👋

The past seven days were exceptionally busy. There was the EU’s vaccine row with AstraZeneca, clashes between farmers and police in India, military exercises in the South China Sea, a slew of Big Tech earnings and lots more. But this edition of Deep Dive focuses on three different topics: the role of weapons in Washington’s relations with its Gulf Arab allies; how retail investors united to spook Wall Street; and growing awareness around mental health issues in the workplace.

As always, let me know your thoughts and opinions. Stay curious, Sara x

TIME TO RESET RELATIONS?

Joe Biden is maintaining momentum on enacting his campaign promises. Amid a flurry of executive orders, the US President asked the State Department to hit the pause button on multi-billion dollar arms deals with Saudi Arabia and the UAE. Among them is the sale of 50 Lockheed Martin F-35 fighter jets to Abu Dhabi.

The State Department says this is a “routine” action to assess whether the agreements meet US foreign policy objectives, and to demonstrate the new administration’s commitment to transparency.

While the pause and review are indeed common practice, these particular purchases by the Gulf Arab countries are significant. According to CNBC, the deals “represent the most advanced and most classified American weapons systems ever sold to Arab allies”.

Donald Trump’s White House had quickly pushed the sales through in its final months despite opposition from several lawmakers. Trump argued the weapons would keep Iran in check, and it’s also believed he wanted to reward the UAE for normalising ties with Israel as part of the Abraham Accords.

However, many in Congress have long demanded that Washington take a firmer stance against the military ambitions of its GCC partners. For one, the continued presence of the Saudi-led coalition in Yemen has worsened the humanitarian crisis there. Additionally, numerous investigations revealed both Riyadh and Abu Dhabi used US munitions in the conflict.

Then came the murder of journalist Jamal Khashoggi in the Saudi consulate in Istanbul in 2018. His shocking death spurred Congress to pass a bipartisan bill to end US support for the war in Yemen - but Trump vetoed it in April 2019.

Ahead of the November presidential election, Biden vowed to re-examine the US’s relationship with the kingdom and said “Jamal’s death will not be in vain”.

Given those comments, diplomats say Crown Prince Mohammed bin Salman was expecting a change in tone from the Oval Office following the departure of Trump and Jared Kushner. (In public, Riyadh claims it’s optimistic about having an “excellent relationship” with Biden.)

Meanwhile, the UAE’s Ambassador to the US detailed his government’s response via Twitter. Yousef Al Otaiba said the UAE “anticipated a review” and he explained how the F-35 package would enable “the UAE to take on more of the regional burden for collective security, freeing US assets for other global challenges.”

Why are the F-35 jets so high on Abu Dhabi’s wish list? They are sophisticated stealth aircraft - the best on the market, according to defence experts.

At the moment, Israel is the only country in the Middle East to own them - and this tends to complicate matters for Gulf Arab buyers. The reason: the US is legally bound to preserve Israel’s qualitative military edge in the region, which means weapons sales to the GCC must be handled delicately.

Still, the UAE and Saudi Arabia have generally been able to procure what they want from the US. And if the Pentagon and State Department don’t sign off, Russia and China are willing and eager to fill the gap, no questions asked.

JOKE’S ON YOU

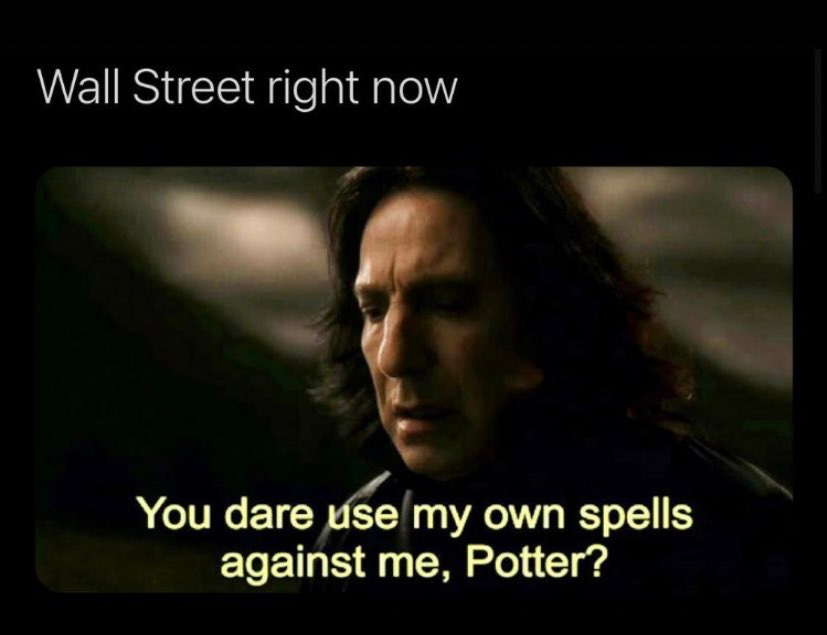

In case you missed it, Wall Street got massively trolled/punk’d/pwned/(insert other Urban Dictionary word) this week.

To recap: A group of day traders, primarily from Reddit’s r/WallStreetBets message board, made a concerted effort to disrupt the plans of a bunch of professional money managers.

When word spread that various hedge funds had heavily shorted GameStop, a struggling video game retailer, the online community banded together to buy the company’s shares to ‘stick it to the man’ - and earn an easy buck in the process.

[Short selling can be a head-scratcher. Put simply, investors bet that the value of a stock will decline and they profit when the drop eventually happens. But the reverse is true as well, those investors lose if the price rises.]

What’s ensued is a David versus Goliath-type situation, pitting retail investors (average folk) against institutional investors (think: pensions, mutual funds and insurance firms). The Redditors helped send GameStop shares up a whopping 1,600% in January. They also shifted their attention to similar floundering brands, such as movie theatre chain AMC, BlackBerry and Bed Bath & Beyond.

The fallout has been catastrophic for some in the industry. According to recent estimates cited by Business Insider, funds shorting GameStop stock were sitting on losses of about US$19 billion on Friday.

But the Reddit army’s glee has since turned to anger. The main brokerages, including Robinhood and E-Trade, announced they would restrict transactions to reduce volatility and risks. Robinhood, in particular, is coming under fire. Google has reportedly removed thousands of negative reviews from its app store, and a class action lawsuit against Robinhood was filed on Thursday.

As the brokerages pumped the brakes, scores of disgruntled users wondered why they were being regulated when the ‘suits’ manipulate equities everyday. A central narrative of this market frenzy is righting the wrongs of the 2008 credit crisis and eliminating Gordon Gekko’s “greed is good” mentality. It’s a sort of Occupy Wall Street 2.0 activism.

But are r/WallStreetBets et al. capable of democratising the investing world? Reddit co-founder Alexis Ohanian has described it as “the start of a new era” and says these online traders expose how the financial system is “rigged”. Others aren’t convinced, calling the orchestrated rally an unsustainable strategy. After all, GameStop’s fundamentals remain weak and an artificially inflated share price won’t lift revenues.

Ironically, the influence of younger retail investors was on the financial services radar in 2020. Dozens of articles were written on the influx of amateur traders and the so-called Robinhood effect. Market watchers listed diverse factors for their ascendance, from boredom during lockdown to stimulus cheques to the gamification of trading through apps.

This phenomenon even drove the stock splits of Apple and Tesla last August as both corporations sought to attract small-time investors.

How far can the Reddit rebellion go? Will there really be a short squeeze on silver next? If this is equivalent to gambling, does the house always win? Morgan Stanley’s CEO warned that the Reddit traders were “in for a rude awakening”.

PEACE OF MIND

The World Economic Forum’s virtual Davos conference wrapped up on Friday.

In light of the Covid-19 emergency, mental health featured strongly on the 2021 agenda with the Forum launching a dialogue series to support global efforts toward mental health outcomes, and to make wellness in the workplace an urgent priority.

I spoke to Laura Aiken, a chemical engineer turned DEI (Diversity, Equity and Inclusion) consultant, about these trends and their impact.

Q. What do resilience and wellness mean to you?

Resilience is an integral part of wellness. Resilience is our ability to navigate life's challenges. It's not about brute strength, it's about flow; meeting experiences as they come and not being thrown by them. It's also not about being unfazed or unemotional in the face of difficulties. Rather, it’s the ability to assess how something is affecting you, which is a very important factor in choosing how to act.

Importantly, personal resilience is something that each of us can build - and resilience requires just that, a continuous, incremental effort to hone self awareness, boost your energy reserves, and build habits that support yourself. This way, when stress, anxiety, or struggle does come (because, unfortunately, we can't control these things), we have the tools to be able to move through it.

When you have an awareness of your resilience, you have a key tool in building and sustaining mental, physical, and emotional wellness.

Q. Society and companies are increasingly embracing the importance of wellness and mental health, especially since the onset of the pandemic. But do you see room for improvement?

It's been so encouraging to see the uptick in mental health awareness and actions to improve employees’ well-being, from mental first aiders to reducing stigma around therapy. These are incredible steps in the right direction.

However, there are two key things still missing for me. The first is a fundamental understanding of what’s draining a person to the point where they have poor mental health. This requires significant self-awareness and often someone to help (mindfulness and embodiment practices like meditation and yoga are beneficial too). Of course, if someone is facing serious mental health issues, such as chronic anxiety, depression or suicidal ideation, there are possibly bigger issues at play than their working environment and they should work with a therapist.

The second is the current corporate culture. Individuals may be doing their best to implement habits that support their well-being, but these become impossible to maintain with demanding deadlines, work hours and an environment that is starved of genuine connection between people. It's do, do, do; at any cost. If companies really value mental health, they need to ask serious questions about whether they have a culture that supports it. Does this project NEED to be done by next week? Have we staffed enough so our people are not working upwards of 10 hours a day? Are we rewarding people who are delivering at the cost of their health? What kind of example do our leadership set for the organisation?

Unfortunately, many companies are hamstrung by the overall corporate climate - it's hard to take a lead and maintain a competitive edge when your customers, suppliers and competitors are not in step. But it's also hard to deliver when all your people are getting sick in the pursuit of success.

Q. Many people are a few weeks into their New Year's resolutions or goals for the year ahead. Can you recommend any tips to ensure they reach their targets?

It's all about small steps and implementing habits that support them - get clear on the end goal and then break it down to a point that is almost ridiculous. What is one tiny thing you can do every day to get there? A ladder with 50 smaller steps will still get to the same place as a ladder with 10 big ones.

And don't forget to have fun. Set at least one "goal" to ensure that you're doing something you love to do, something that makes you laugh or smile. All work and no play makes Jack totally drained and unmotivated to go and achieve his goals! I do have goals for the year, but my New Year's resolutions are much more silly: Have more fun, take more naps, and drink more champagne.

Thanks for reading! Please feel free to share this newsletter with your family and friends.